Dental and Medical Practice Services

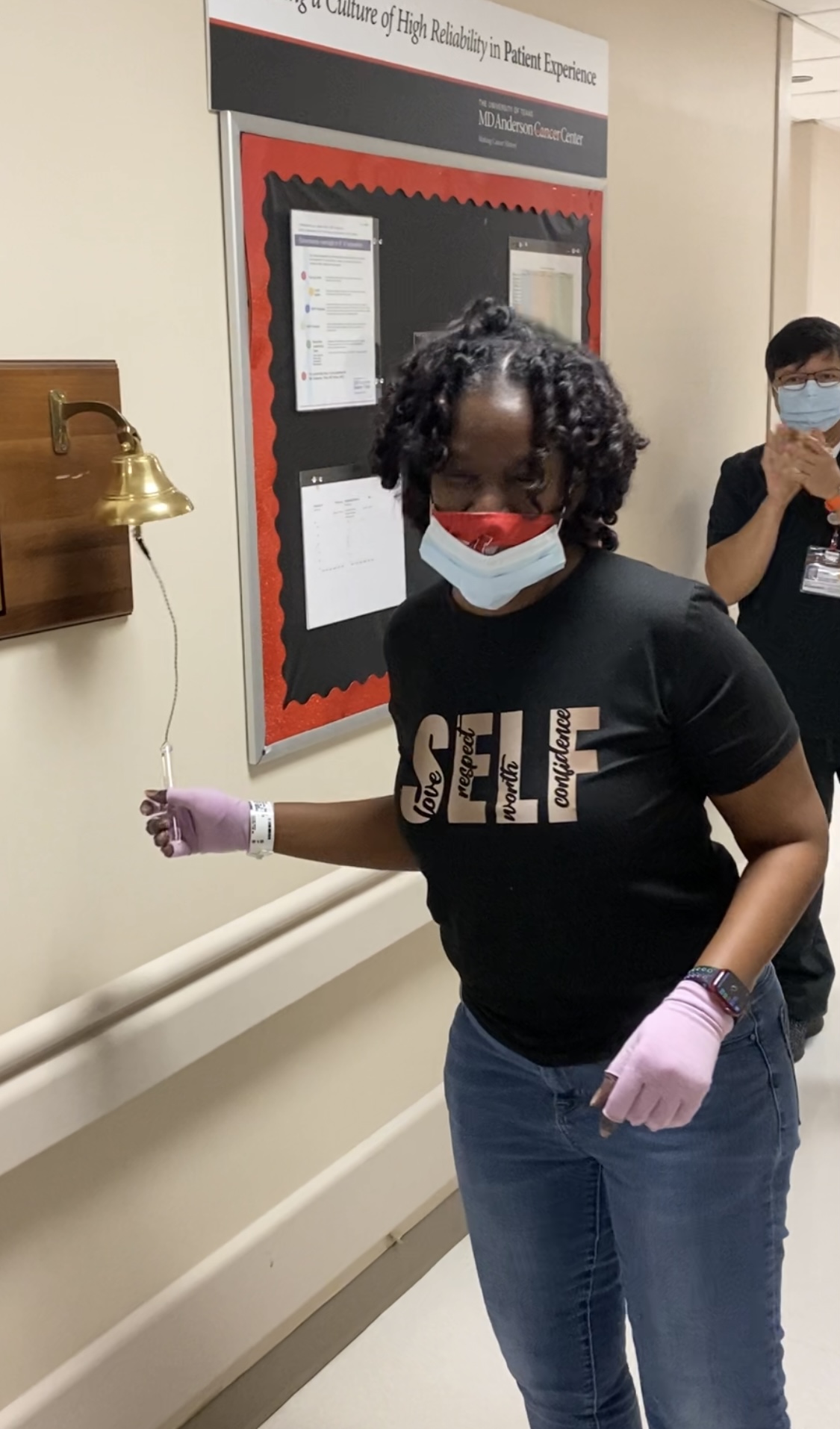

As a cancer survivor, I have a special place in my heart for healthcare professionals. In the midst of the many obligations that you face (compliance, patient care, finances) your steadfast commitment to service inspires me. Healthcare professionals are able to change lives, save lives, and uplift lives. Wow! You are our modern-day heroes.

~ Sheryl J. Jimerson, CPA, EA, MBA, CSPPM

As a dental or medical practice owner, you have specialized needs and concerns. Not only are you ensuring top care for your patients, but you are also meeting an abundance of compliance requirements, managing payroll, managing payer relationships, filing and paying taxes, and the list goes on. Here is how we can come alongside you to help you meet your financial goals and relieve some of your burden:

Financial and Tax Considerations

Financial planning and analysis: We can help you increase profitability. We can develop financial plans and budgets, forecast financial performance, conduct financial feasibility studies, and provide insights for strategic decision-making.

Tax planning and optimization: We can help you optimize your tax positions, minimize taxes, take advantage of relevant deductions and credits, and ensure compliance with tax laws.

Tax Compliance: We can help you ensure compliance with applicable federal and state tax laws, regulations, and reporting requirements. This involves staying updated on tax law changes, filing tax returns accurately and on time, and maintaining proper documentation.

Entity Structure: We can help you choose the appropriate legal entity structure for the business, such as a sole proprietorship, partnership, corporation, or limited liability company (LLC). The entity structure can impact the tax treatment of income, deductions, and liability.

Income and Expense Planning: We can help you optimize the timing and classification of income and expenses to minimize taxable income. This includes strategies such as deferring income, accelerating deductions, and properly categorizing expenses for tax purposes.

Tax Credits and Incentives: We can help you identify and leverage tax credits, deductions, exemptions, and incentives available within the tax code. This may include research and development (R&D) tax credits, investment tax credits, energy-efficient deductions, and industry-specific incentives.

Retirement Planning: We can help you explore retirement plans and strategies that offer tax advantages, such as individual retirement accounts (IRAs), 401(k) plans, or pension plans. These plans can provide tax deferral benefits or deductions for contributions.

Estate and Succession Planning: We can connect you with resources to develop strategies to minimize estate and gift taxes while efficiently transferring wealth to the next generation. This includes utilizing techniques like trusts, family limited partnerships, and charitable giving to optimize tax outcomes.

Cost Optimization

Process Efficiency: We can help you identify and improve inefficient processes that consume resources and increase costs. This may involve streamlining workflows, eliminating redundancies, and optimizing resource allocation.

Resource Allocation: We can help you assess the allocation of resources, such as personnel, equipment, and facilities, to optimize utilization and minimize waste. This includes analyzing staffing levels, capacity planning, and optimizing the use of assets.

Cost Control and Monitoring: We can help you implement effective cost control measures and establish systems to monitor and track expenses. This involves budgeting, expense tracking, variance analysis, and implementing cost control policies.

We are honored to have won awards for our Physician Practice Accounting and Tax Services. We pride ourselves on having great customer service for clients in Houston and across the country. We take time to help you by walking you through the planning process. Accounting can be overwhelming for some. Let us help you move forward and free your time up!

Suggested Services

For practices with $1,000,000 or less in revenues, we recommend a one-on-one intensive session which allows us to focus on the specific needs of your practice. We will come up with an action plan to propel business growth and profitability. Please contact our office to schedule.